Savings Up in Smoke: The Impact of Cigarette Smoking in Kashmiri Homes

Every day in Kashmir, the sight of lit cigarettes is a common occurrence in homes, shops, and streets. While providing temporary relief, this habit comes at the cost of both health and financial stability.

Studies reveal that over 20% of adults in Jammu and Kashmir engage in tobacco use, with regular spending on cigarettes draining significant financial resources that could otherwise be directed towards savings or investments for a more secure financial future.

The prevalence of tobacco use in the region ranks among the highest in India, with a notable percentage of adults, particularly men, being regular smokers. Districts like Kupwara exhibit particularly high rates of smoking.

Research indicates that tobacco consumption starts at a young age in conflict-affected areas, influenced by social stress, unemployment, and political tensions. This early initiation into smoking has long-term implications on public health and the well-being of the youth.

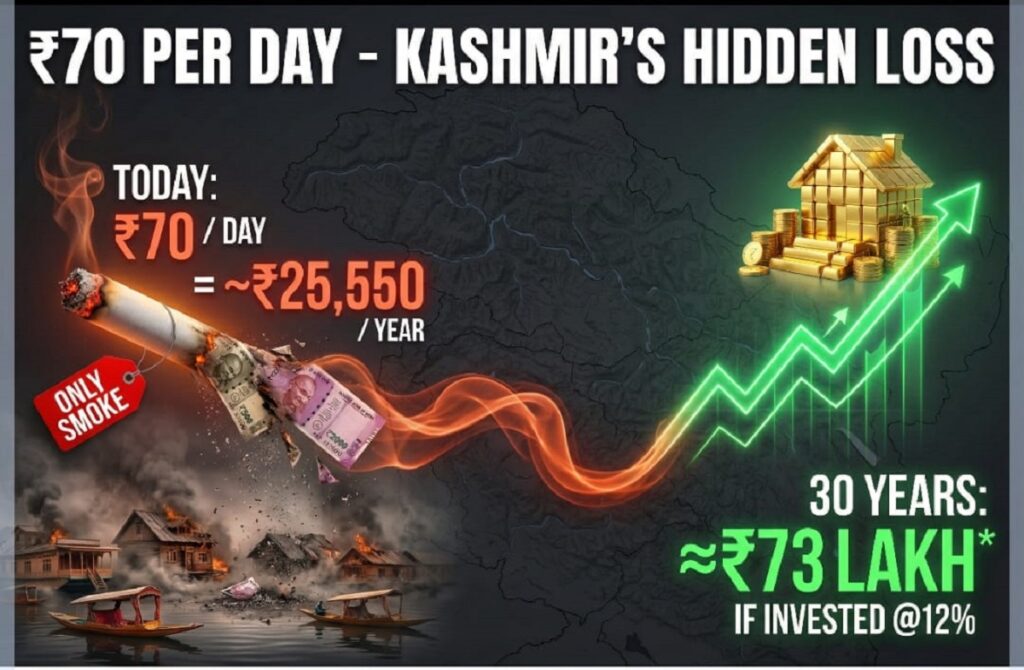

Aside from health concerns, the financial impact of smoking is substantial. While the purchase of a pack of cigarettes may seem trivial, the cumulative expenses over time can amount to a significant sum. National statistics highlight the economic losses incurred by India due to tobacco-related costs, including healthcare expenses and reduced productivity.

Redirecting daily expenditure on cigarettes towards savings or investments could lead to substantial financial gains for households. The money spent on smoking could instead be utilized for education, homeownership, or building an emergency fund.

Furthermore, the health consequences of tobacco use, such as heart disease, stroke, lung conditions, tuberculosis, and cancer, contribute to a significant burden on the healthcare system and individual households.

With lung cancer rates on the rise in Kashmir, the link between smoking and these diseases is becoming increasingly evident. The detrimental effects of combustible tobacco consumption result in numerous deaths and illnesses across India annually.

Households often bear the brunt of tobacco-related expenses, resorting to using income, accruing debt, or selling assets to cover medical bills. This financial strain not only affects current expenses but also impacts future investments and the overall economic stability of families.

As household savings play a crucial role in driving India’s economic growth, it is imperative for families to consider alternative investment options, such as mutual funds and SIPs, to secure their financial future.

By making small, regular investments through SIPs, individuals can leverage compounding and rupee-cost averaging to build substantial wealth over time. Redirecting funds from cigarette purchases to SIPs can lead to long-term financial security and asset accumulation.

Reducing tobacco consumption in Kashmir has the potential to yield economic benefits, as evidenced by studies projecting increased GDP and job creation with even a modest reduction in smoking rates.

The decision to quit smoking and invest the saved money can contribute to stronger incomes, thriving local businesses, and a community focused on education, tourism, and entrepreneurship rather than tobacco consumption and healthcare expenses.

Kashmir faces a critical juncture where the once-accepted practice of smoking is now recognized as a dual threat to health and wealth. With rising youth smoking rates, households must weigh the consequences of continued smoking against the benefits of education, investment, and financial security.

Choosing to prioritize savings over smoke presents Kashmiri families with the opportunity to reclaim financial resources currently spent on cigarettes and channel them towards long-term wealth creation. This decision will shape the valley’s future, determining whether it is marked by illness and debt or financial and physical well-being.