Silver Price Hits Record High, Gold Retreats in Delhi

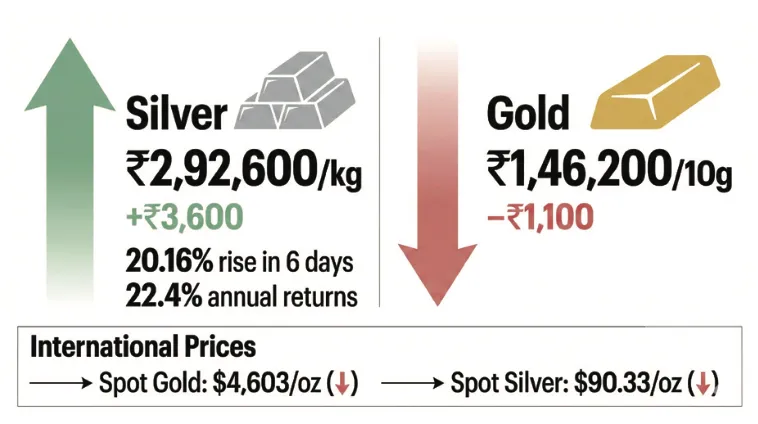

In New Delhi, the silver price continued its remarkable rally for the sixth consecutive day, reaching a new record high of Rs 2,92,600 per kilogram on Friday. This surge was fueled by steady buying from stockists, as reported by the All India Sarafa Association.

On the other hand, 99.9% pure gold saw a slight decline from its peak, dropping by Rs 1,100 to Rs 1,46,200 per 10 grams (inclusive of all taxes) from the previous session’s Rs 1,47,300 per 10 grams.

Just a day earlier, silver had closed at Rs 2,89,000 per kilogram. Traders attributed silver’s resilience to strong industrial demand, disregarding weak global trends.

Over the course of six sessions, silver has surged by 20.16%, or Rs 49,100, starting from Rs 2,43,500 per kilogram on January 8. This upward trend positions silver as the outperformer compared to gold for the second consecutive year, with a return of 22.4%.

Internationally, spot gold and silver experienced a decline for the second consecutive day, with prices slipping due to a stronger US dollar and reduced geopolitical tensions in the Middle East.

Spot gold saw a decrease of USD 12.46, or 0.27%, to USD 4,603.51 per ounce. Praveen Singh, Head of Commodities at Mirae Asset ShareKhan, noted, “Spot gold is currently trading around USD 4,606 per ounce, down by 0.25%. The yellow metal is facing pressure following the US strike on Iran being averted.”

Meanwhile, spot silver dropped by 2.26%, or USD 2.08, to USD 90.33 per ounce on Friday. The previous session had seen silver reach a new peak of USD 93.57 per ounce before experiencing an 8% plunge to USD 86.30 per ounce after the US administration decided against imposing an import tax on silver and other key metals.

Gaurav Garg, Research Analyst at Lemonn Markets Desk, mentioned, “Precious metals saw a decline on Friday after reaching record highs earlier in the week, impacted by a strong US dollar and reduced expectations of an immediate Federal Reserve interest rate cut.”

Despite the short-term profit-taking triggered by strong US jobs data, the underlying fundamentals remain supportive for precious metals. Gold continues to benefit from global economic uncertainties and central bank purchases, while silver is bolstered by industrial demand, particularly from the green energy and electronics sectors.

Overall, the precious metals market is influenced by a variety of factors, including geopolitical events, economic indicators, and currency movements, making it essential for investors to stay informed and adaptable in this dynamic environment.