Understanding the Impact of Global Factors on Gold Prices

Gold prices have been on a rollercoaster ride due to various global factors. The surge in prices was fueled by fears of inflation, geopolitical tensions, and weakening currencies, leading investors to flock to the safe haven of gold.

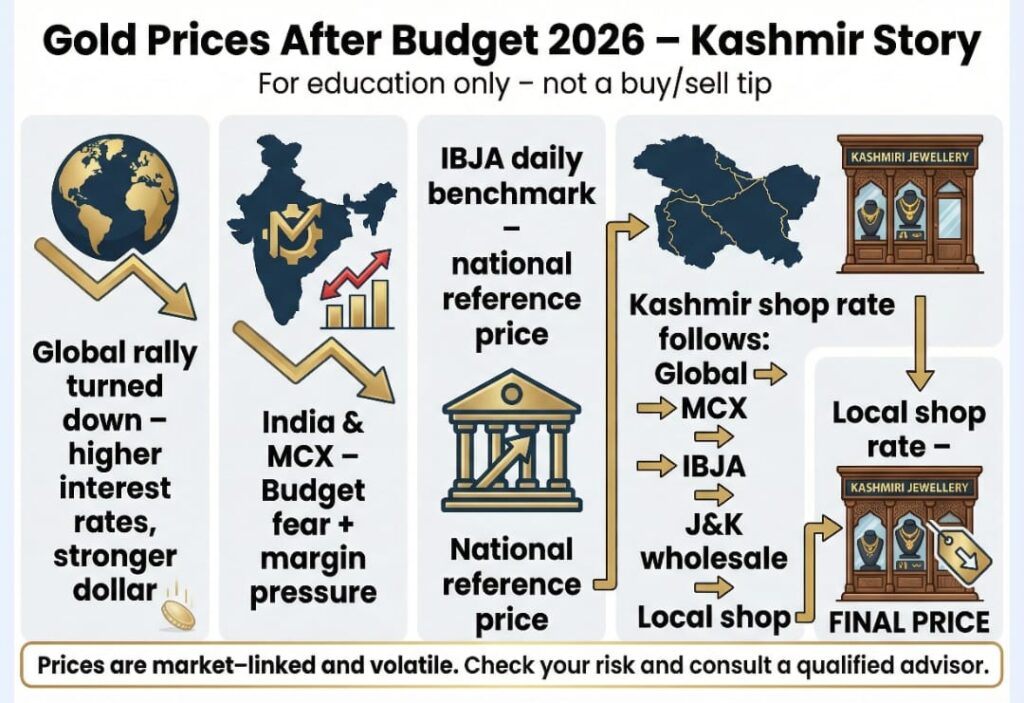

However, a shift in market sentiment, driven by expectations of prolonged high interest rates in major economies and a strengthening US dollar, caused a sudden reversal in gold prices. This downturn was exacerbated by large investors booking profits and unwinding their positions.

India, being a major importer of gold, felt the impact of these global fluctuations acutely. The domestic gold market closely tracks international prices and exchange rates, making it vulnerable to rapid changes in the global landscape.

During the recent turbulence in gold prices around the Union Budget 2026, market participants in India, including traders and jewellers, faced significant challenges. Margin calls, increased volatility, and changing regulatory requirements added further complexity to an already volatile market.

The India Bullion and Jewellers Association plays a crucial role in setting benchmark rates for gold in the country, influencing everything from bank valuations to retail prices. The interconnected nature of the global and domestic gold markets underscores the need for a nuanced understanding of the factors driving price movements.

For consumers in Kashmir, the journey of a gold price—from global markets to local jewellers—is a complex one involving multiple stakeholders and cost components. Understanding this process can help individuals make informed decisions when buying or selling gold.

While gold remains a popular investment choice for many households, it is essential to approach it with caution and diversify one’s portfolio to mitigate risks. Whether trading in futures or purchasing physical gold, being aware of the underlying market dynamics is crucial for making sound financial decisions.

Ultimately, the fluctuating nature of gold prices serves as a reminder of the interconnectedness of global financial markets and the importance of staying informed and strategic in one’s investment approach.

Whether you are a seasoned investor or a first-time buyer, navigating the intricacies of the gold market requires diligence, foresight, and a willingness to adapt to changing market conditions.