The 2026 Union Budget: A Closer Look at Jammu and Kashmir’s Financial Landscape

The recently unveiled 2026 Union Budget for Jammu and Kashmir underscores the crucial role of public services and infrastructure projects in the region, while also shedding light on the persistent challenge of balancing expenditures with local revenue.

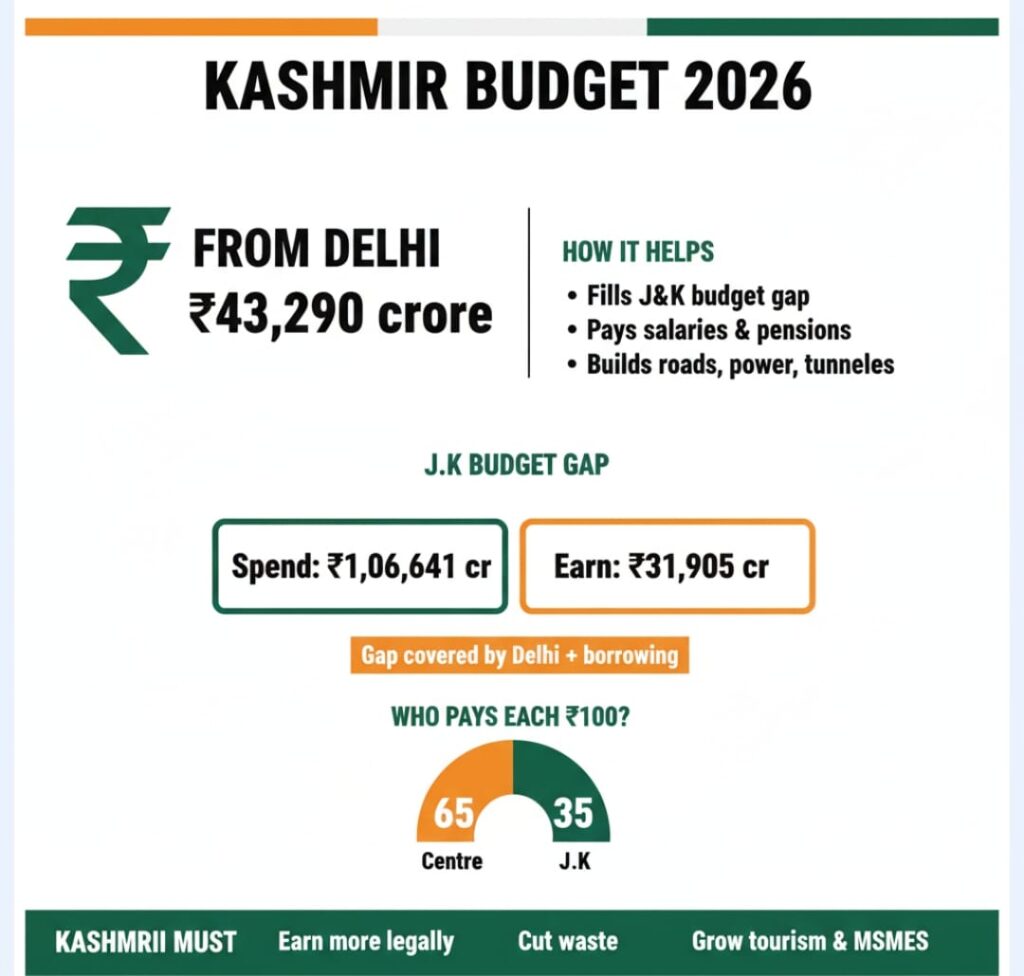

Allocating a substantial ₹43,290 crore for the fiscal year 2026-27, the budget outlines the critical funding required to sustain essential services such as schools, hospitals, and public initiatives throughout the region. Notably, the majority of this allocation, amounting to ₹42,650 crore, comprises central assistance aimed at bridging the gap between planned expenditures and locally generated income. A smaller portion is earmarked for disaster relief and other specific needs.

Comparing the 2026-27 budget with the previous fiscal year highlights the scale of financial support provided to Jammu and Kashmir. With total planned spending reaching ₹1,06,641 crore, local revenue from taxes and other sources only amounts to ₹31,905 crore. The shortfall is covered by transfers from Delhi, estimated at ₹58,600 crore, and additional borrowing, resulting in a fiscal deficit of approximately ₹16,107 crore.

Revenue and Expenditure Breakdown:

Examining the income sources, local tax collections, including GST, excise, and stamp duty, contribute around ₹20,900 crore, while non-tax revenue from power bills, fees, and services adds nearly ₹11,000 crore. In total, local income stands at approximately ₹31,900 crore, with Delhi emerging as the primary funding source.

Delving into spending patterns reveals the intricate financial framework at play. Total expenditure, excluding debt repayment, amounts to ₹1,06,641 crore, with a significant portion of ₹79,800 crore allocated towards day-to-day operations encompassing salaries, pensions, power subsidies, medicines, and school meals. Capital expenditure, covering infrastructure projects like roads, tunnels, schools, and power facilities, accounts for about ₹26,800 crore.

Within the realm of revenue spending, salaries consume roughly 26% of receipts, pensions around 17%, and interest on past borrowings about 12%, collectively absorbing over half of the government’s income before any allocation towards new development initiatives.

Dependency on Central Support:

Jammu and Kashmir’s historical reliance on central assistance is evident, with a significant portion of total revenue sourced from Delhi. Over the years, the region has received substantial central grants, surpassing its share of the national population. Presently, about 65% of revenue stems from the Centre, underscoring the ongoing dependence on external funding.

The structural composition of the local economy contributes to this reliance, with sectors such as apples, tourism, handicrafts, small trade, and public employment generating limited taxable surplus compared to industrial hubs in other states. Additionally, the region’s challenging terrain, extended winters, border regions, and dispersed settlements elevate the costs of infrastructure development and maintenance.

Future Financial Sustainability:

Addressing the longstanding financial imbalance necessitates strategic decisions to enhance local revenue generation and optimize expenditure efficiency. Initiatives to stimulate economic growth, streamline taxation processes, and prioritize revenue-generating assets are imperative for reducing the dependency on external funding sources.

Efforts to bolster income streams should focus on simplifying regulations for small businesses, promoting digital transactions, and enhancing compliance mechanisms to expand the tax base. Moreover, improving revenue collection from power bills, property charges, and user fees can bolster financial inflows if executed meticulously.

On the expenditure front, maintaining support for vulnerable populations while implementing progressive pricing strategies can enhance revenue while ensuring equitable distribution of resources. Embracing technology for efficient pension administration, staff management, and resource allocation can mitigate escalating salary and pension costs.

Strategic reallocation of funds from underperforming programs to job-generating initiatives can optimize spending and drive economic growth. Long-term investments in sectors like tourism, horticulture, handicrafts, small industries, and IT services can yield sustainable returns and foster economic resilience.

Charting a Path to Financial Autonomy:

As Jammu and Kashmir endeavors to reduce its reliance on external funding, the goal of increasing local revenue contribution to at least 50% over the next decade remains paramount. Each budget cycle should reflect a gradual transition towards self-sufficiency, characterized by a thriving formal economy, completed projects yielding returns, and a diminishing fiscal deficit.

While the 2026 Budget underscores the significant role of central funding in sustaining the region’s current financial landscape, the true test lies in cultivating a future where local revenue forms the bedrock of public spending. This transformative shift, rather than the quantum of financial support, will signify genuine financial resilience and sustainability.