Silver and Gold Prices Plummet Amid Global Selloff

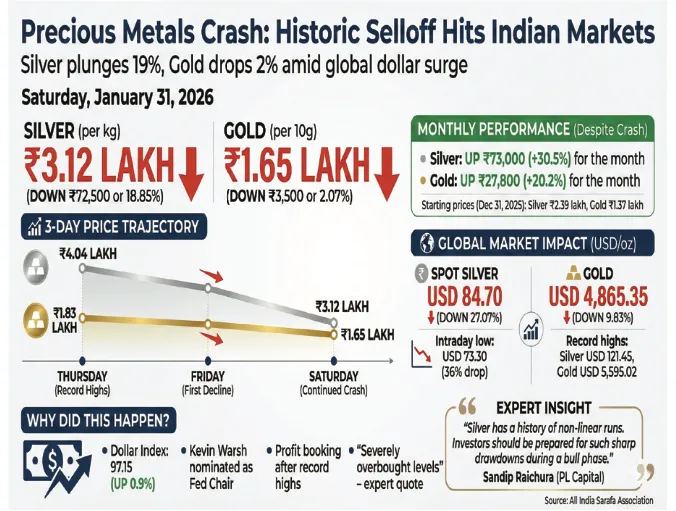

On a tumultuous Saturday in the national capital, silver prices took a nosedive of 19 per cent to reach Rs 3.12 lakh per kg, while gold also saw a significant drop of 2 per cent to Rs 1.65 lakh per 10 grams. This drastic decrease was a result of investors booking profits amidst a global selloff triggered by the strengthening US dollar.

The All India Sarafa Association reported that silver plummeted by Rs 72,500, marking an 18.85 per cent decrease to Rs 3,12,000 per kilogram, inclusive of all taxes. This decline comes after a series of heavy losses over the past few days, erasing much of the gains made earlier in the week.

Just a day prior, the white metal had hit a record high of Rs 4,04,500 per kg before experiencing a 5 per cent drop in the previous session. Despite these setbacks, silver prices ended January with significant gains, rising by Rs 73,000 or 30.5 per cent from the end of December.

Similarly, gold prices also witnessed a decline, sliding by Rs 3,500 or 2.07 per cent to Rs 1,65,500 per 10 grams, inclusive of all taxes. The 99.9 per cent pure metal saw a 7.6 per cent decrease to Rs 1,69,000 per 10 grams in the previous trade after reaching a record high of Rs 1,83,000 per 10 grams.

Throughout January, gold prices saw a notable increase of Rs 27,800 or 20.2 per cent from the end of the previous year. Analysts attributed this sell-off to a rebound in the dollar, which exerted downward pressure on both gold and silver prices.

The dollar index rose by 0.9 per cent, closing at 97.15 after US President Donald Trump nominated Kevin Warsh, a former Fed governor known for advocating a strong dollar, to lead the Federal Reserve. This move dampened the appeal for safe-haven assets such as gold and silver.

While the decline in silver and gold prices was significant in domestic markets, the impact was even more pronounced globally. Spot silver plummeted by USD 31.44 or 27.07 per cent to close at USD 84.70 per ounce, with gold also dropping by USD 530.53 or 9.83 per cent to settle at USD 4,865.35 per ounce.

Despite hitting all-time highs on Thursday, with silver reaching USD 121.45 and gold at USD 5,595.02 per ounce due to safe-haven demand, both metals experienced substantial losses in the recent selloff.

Looking ahead, industry experts predict a continued upward trajectory for gold, with expectations of reaching USD 6,000 and eventually USD 8,000 over the next two years. While silver may see further declines, it is anticipated to stabilize around the USD 60 per ounce level.

Market analysts emphasize that the recent pullbacks in bullion prices are healthy consolidations rather than trend reversals, with the broader bullish outlook for precious metals remaining intact. However, elevated prices are beginning to impact physical demand, particularly in price-sensitive markets like India, indicating that near-term volatility may persist.

As jewellers anticipate policy support ahead of the Union Budget to revive demand, the precious metals market remains dynamic and subject to various global and domestic factors influencing price movements.